Revolutionizing Traditional Financial Instruments

Marmara Credit Loops are a novel financial innovation that harnesses the power of blockchain technology to improve the functionality of traditional financial instruments like post-dated checks and promissory notes. In this post, we'll delve into how Marmara Credit Loops work, and then compare them to their traditional counterparts. Get ready for a game-changing perspective on financial transactions!

Revolutionizing Traditional Financial Instruments

Introduction:

Marmara Credit Loops are a novel financial innovation that harnesses the power of blockchain technology to improve the functionality of traditional financial instruments like post-dated checks and promissory notes. In this post, we'll delve into how Marmara Credit Loops work, and then compare them to their traditional counterparts. Get ready for a game-changing perspective on financial transactions!

How Marmara Credit Loops Work:

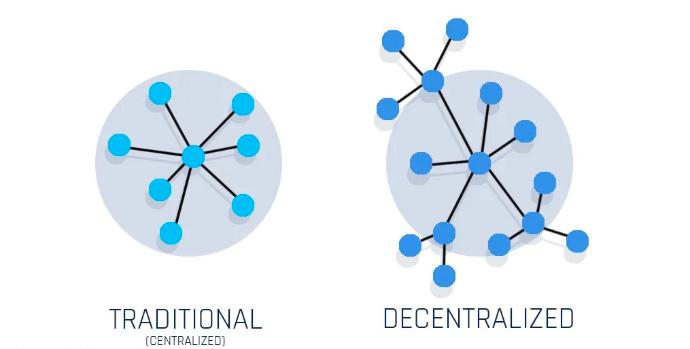

Marmara Credit Loops are built on the Marmara Chain, a blockchain platform specifically designed to facilitate credit transactions. The system uses a combination of partial collateral, a trust mechanism involving escrow, and blockchain technology to provide secure, interest-free credit transactions.

Creating a Credit Loop: When a participant wants to issue credit, they create a credit loop that involves the issuer, endorsers, and their respective avalists (guarantors). These loops can be endorsed and transferred between parties, just like traditional post-dated checks and promissory notes.

Collateral: Participants lock a portion of their MCL coins as collateral to create trust within the credit loop. This collateral is used to protect against defaulting.

Trust Mechanism: The Marmara Chain system utilizes escrow agents to establish trust between participants. The escrow agents lock MCL coins in a smart contract fund and approve credit transactions within the loop.

Blockchain Technology: The Marmara Chain ensures the security and transparency of all transactions within the credit loop. It provides an immutable record of credit history, which helps establish trust between participants.

Comparing Marmara Credit Loops with Post-dated Checks and Promissory Notes:

Security: Marmara Credit Loops offer enhanced security through their use of blockchain technology, ensuring that transactions are transparent and immutable. Traditional post-dated checks and promissory notes rely on paper documentation and can be more susceptible to fraud.

Trust: The Marmara system's trust mechanism, involving escrow agents and collateral, provides a higher level of trust between participants compared to traditional financial instruments. This trust allows credit loops to function effectively, even when issued by ordinary people.

Interest-Free Transactions: Unlike credit card transactions, Marmara Credit Loops are interest-free, as they are designed to facilitate the exchange of goods and services rather than borrowing money.

Flexibility: Marmara Credit Loops can accommodate a variety of currencies and even precious metals, such as gold or silver, providing greater flexibility than traditional financial instruments.

Conclusion:

Marmara Credit Loops are revolutionizing the way we think about financial transactions. By combining the security of blockchain technology with a robust trust mechanism and flexible, interest-free transactions, Marmara Credit Loops offer a viable alternative to traditional post-dated checks and promissory notes. As an innovative financial instrument, Marmara Credit Loops have the potential to reshape the way we conduct business and manage credit, providing a more secure, trustworthy, and efficient system for all parties involved.