History & Ethos

Marmara Credit Loops (MCL), the First and Only DeFi System of the World Designed to Run in Real Economy.

Marmara Credit Loops (MCL) is the first and the only Decentralized Finance (DeFi) system in the World designed to run in real economy. The system rewards buyers and sellers when shopping with credit loops instead of cash. It works as an independent smart chain with a 25% mineable and 75% stakeable coin integrated with two DeFi protocols. The system uses UTXO based Turing Complete Smart Contracting system powered by Komodo Platform.

Marmara Chain is protected against 51% attacks by means of Komodo dPoW technologies which recycle the hash power of Bitcoin by backing up independent blockhains on the Bitcoin network.

Staking could only be done when users lock their coins in one of the two different funds, namely; “Activated” and “Locked in Credit Loop” (LCL) funds. When coins are locked in LCL funds, both issuer and holder(s) of credit have the chance for 3x staking. The system has a unique solution for coins locked in credit loops unlike other staking systems. Locking coins into credit loops for staking does not make them static. Instead, they can be circulated while they are locked and doing 3x staking via endorsement. The process of credit endorsement is designed to assure that transfer is only meaningful while shopping.

Credit Loops work also similar to post-dated cheques in cultures where redemption is not made before maturity date of a cheque and hence making collateralization unnecessary. The system consists of two protocols; 100% collateralization and under- or zero-collateralization. The first protocol is based on 100% collateralization. It is an interest-free system providing the negative entropy established through the mining and staking rewards on the same chain. The issuer provides the coins required for 100% collateralization until the maturity date of a credit loop. The second protocol is based on money creation with many different fiat and crypto currencies as well as assets such as gold and silver. The second protocol works by merging the trustless blockchain with communities and escrows who provide the required trust layer into system. The protocol 2 was designed to run in a multilaw structure to enable the use universally in any country and community. A third layer of blockchain fund integrated with escrows is maintained as a kind of distributed notarization system to further protect holders of credits against non-redemption.

Marmara Chain Founder

History

Marmara Credit Loops (MCL) is the fruit of the famous Komodo Platform and Marmara Open Innovations Lab at Marmara University based on a real use case based on running almost half of GDP in both Turkey and India.

The story of MCL goes back to 2010 when seeking an interest-free and peer-to-peer alternative to credits in banking where banks create money out of thin air resulting in an unfair economical and social system. The two articles explain the major problems in banking systems [1, 2, 3]. A town story [4] during TV series in 2013 triggered the already existing alternative happening for decades known as post-dated cheques and promissory notes in Turkey. Those post-dated cheques work as analog blockchain in real-economy on a peer-to-peer credit creation basis without bearing any interest. We conducted several workshops by Open Innovation Labs at Marmara University to bring business people and academics. Post-dated cheques and promissory notes as inspiration to project were analzyed to find out the problems many case studies based on interviews. Then in 2016, we started the conceptual framework at Marmara University Open Innovation Laboratory. At the end of search, we discovered that the project could only be realized by an independent chain with a mineable/stakeable coin supporting advanced way of smart contracts based on multilaw principles due to multi-cultural requirements in the system. Further research and especially the Declaration of Independence [5] attracted us towards the Komodo Platform where we discussed the complexities of the work with James Lee, #jl777, the founder of Komodo Platform and we established a partnership to realize the project. Based on the first academic paper for MCL [6], the initial PoC was developed in 2019 by James Lee, the co-founder of Marmara and tests were carried out by hundreds of engineering students and some researchers. Many test chains were established to fine tune the system until the mainnet was started in 17th January, 2020.

The mainnet was started in 17th January, 2020 based on the consensus published in the first academic paper [6]. The consensus was improved later and reflected with second hard fork changes on mainnet in June [7].

1. Gündoğan, M and Çetiner, B. Gültekin (2014), Debt Based Monetary System, CIE44 & IMSS’14 Proceedings, 14-16 October 2014, Istanbul / Turkey, Pages: 2315-2323

2. Werner, R. A. (2016), A lost century in economics: Three theories of banking and the conclusive evidence, International Review of Financial Analysis, Volume 46, July 2016, Pages 361-379

3. Even, Louis (1939), The Money Myth Exploded, 01 January 1939. https://www.michaeljournal.org/articles/social-credit/item/the-money-myth-exploded, Accessed 17th January, 2020

4. jrosenhouse (2009), An Amusing Brainteaser, Accessed 17th January, 2020

5. Lee, James (2016), Declaration of Independence - Atomic Cross Chain Asset Standard, February 21, 2016, Accessed 17th January, 2020, https://bitcointalk.org/index.php?topic=1372879.0

6. Çetiner, B. Gültekin and Lee, James (2019), Marmara Credit Loops: A Blockchain Solution to Nonredemption problem in Post-dated Cheques,10th International Symposium on Intelligent Manufacturing and Service Systems, Pages 1491-1499

7. Çetiner, B. Gültekin (2020), Marmara Kredi Döngüleri’nde yeni hard fork geliyor (New Hard Fork on MarmaraChain), https://uzmancoin.com/marmara-yeni-hard-fork/, Accessed 27th May, 2020.

Mission & Vision

Marmara Credit Loops (MCL), the First and Only DeFi System of the World Designed to Run in Real Economy.

The Vision of Marmara Credit Loops (MCL) is to provide a peer-to-peer alternative for credit creation and circulation on a global scale.

Staking Coins While Shopping

The mission is the mass adoption of cryptocurrencies in real economy for buying/selling goods and services by means of credit loops. Coin production during shopping is unique in the world, especially with its consumer-friendly structure.

We also share the similar mission with Komodo who aims at empowering the communities with their own free independent chains.

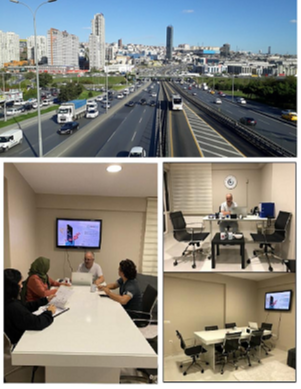

Komodo Turkey Teknopark İstanbul Incubation Office

As Komodo Turkey, our first branch was located in Teknopark Istanbul Incubation Centre. Not only Marmara Credit Loops (MCL) but also other projects are being developed in the incubation center. There are more than 300 local and international companies in Teknopark Istanbul, engaged in R&D researches for high technology developments. It provides 2.5 million square meters of land with more than 5000 qualified personnel employed in Teknopark Istanbul, where work on more than 1500 new projects continues.

Marmara University Open Innovations Lab

Marmara Open Innovations Laboratory was established under Industrial Engineering Department at Marmara University, Faculty of Engineering in 2015. All kind of Open source projects based on Open Software and Open Hardware concept are supported.

We provide support to empower students in their innovative works and in related courses with 3D Printers and similar technologies to have prototyping support for their ideas.

Marmara Credit Loops (MCL) was developed as one of the major projects in collaboration with Komodo Platform.

Komodo Turkey İstanbul

Kadıköy (Kozyatağı) Office

The second branch of Komodo Turkey is located nearby business centres and several university campuses in Kadıköy Kozyatağı region in Istanbul. As being in the city centre, it is not only easily reachable to facilites but also to public transportations such as Underground Istanbul (Metro) and E5 motorway, i.e the main road of the country connecting up to international borders.

The office provides software development, training facilities suitable to conduct workshops in the related fields. The company activity fields mainly include Blockhcain projects, Housing, Energy, 3D Printing, etc but not limited.