Calculation of Marmara (MCL) Staking on Marmara Chain

Anyone can calculate the estimated staking on Marmara Chain.

In this blog, We will show the software developers on how to calculate estimated earnings from staking on Marmara Chain. If you want to build a startup on Marmara Chain, it might be useful to add that.

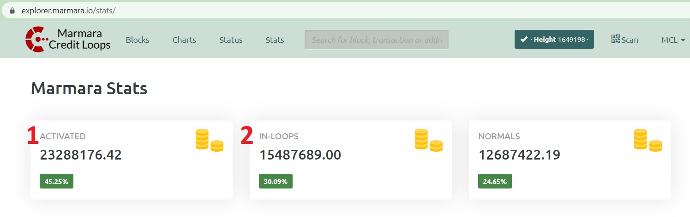

Step 1: Get the Marmara Stats

In order to calculate the estimated earnings for staking, you need to get the snapshot of Marmara Stats. You can see the stats below. There are two parameters used to calculate the estimation of staking rewards. For calculating earnings, you need to get them from json data. You can use any of three Marmara Blockchain explorer sites to get the required json data. They are Explorer Stats, Explorer 2 Stats and Explorer3 stats. The content of json looks like as follows:-

{"info":{"height":1650028,

"TotalNormals":12659733.145516701,

"TotalPayToScriptHash":17151.239519860064,

"TotalActivated":23343226.43283814,

"TotalLockedInLoops":15480689,

"TotalSupply":51483648.578354836,"time":1679258005}}

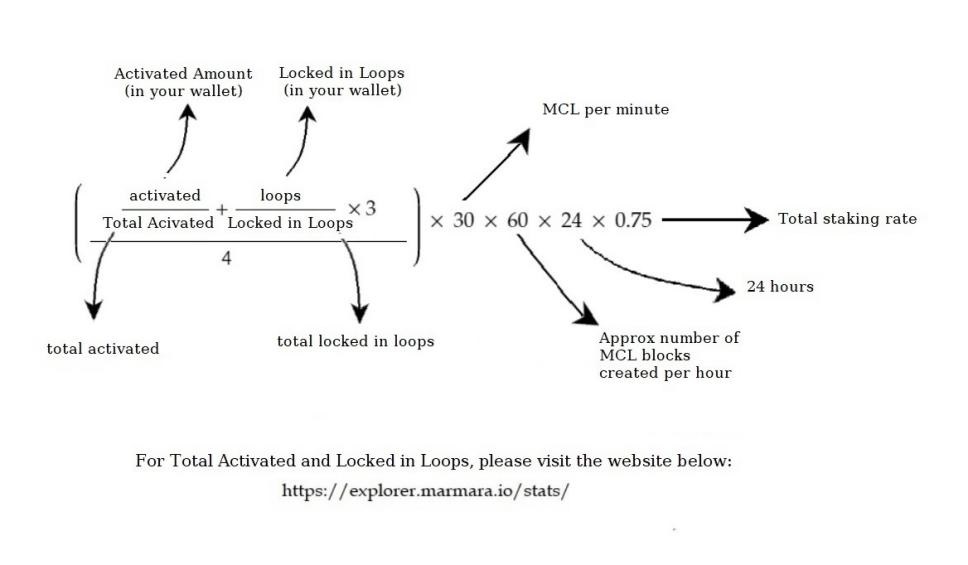

Step 2: Calculating the Staking Rewards for MCL

Two parameters are required from the json data. They are TotalActivated and TotalLockedInLoops. These are the total locked coins in Activated and Credit Loop Contracts. The following formula is used to calculate the daily earnings from staking on Marmara Chain.

The user needs to provide two values namely user_coins_activated and user_coins_loops. The parameters are explained in the formula. They are straightforward to calculate.

The user needs to provide two values namely user_coins_activated and user_coins_loops. The parameters are explained in the formula. They are straightforward to calculate.

Step 3: Code to Calculate Staking Rewards for MCL

The simple code is provided for Python.

import requests

def fetch_marmara_data():

url = "https://explorer.marmara.io/insight-api-komodo/stats"

response = requests.get(url)

if response.ok:

data = response.json()

return data["info"]

else:

raise Exception("Failed to fetch Marmara data")

def calculate_yearly_expected_roi(user_coins_activated, user_coins_loops):

marmara_data = fetch_marmara_data()

total_activated = marmara_data["TotalActivated"]

total_locked_in_loops = marmara_data["TotalLockedInLoops"]

daily_staking_rewards = (((user_coins_activated / total_activated) + (user_coins_loops / total_locked_in_loops) * 3) / 4) * 30 * 60 * 24 * 0.75

yearly_staking_rewards = daily_staking_rewards * 365

total_investment = user_coins_activated + user_coins_loops

yearly_roi = (yearly_staking_rewards / total_investment) * 100

expected_mcl_coins = total_investment + yearly_staking_rewards

return daily_staking_rewards, yearly_roi, expected_mcl_coins

user_coins_activated = float(input("Enter User Coins Locked in Activated: "))

user_coins_loops = float(input("Enter User Coins Locked in Credit Loops: "))

daily_staking_rewards, yearly_roi, expected_mcl_coins = calculate_yearly_expected_roi(user_coins_activated, user_coins_loops)

print(f"Original Investment: {user_coins_activated + user_coins_loops:.2f} MCL")

print(f"Daily MCL Earning: {daily_staking_rewards:.2f} MCL")

print(f"Yearly Expected ROI: {yearly_roi:.2f}%")

print(f"Expected MCL Coins at the End of the Year: {expected_mcl_coins:.2f} MCL")Step 4: Check Your Calculation Results

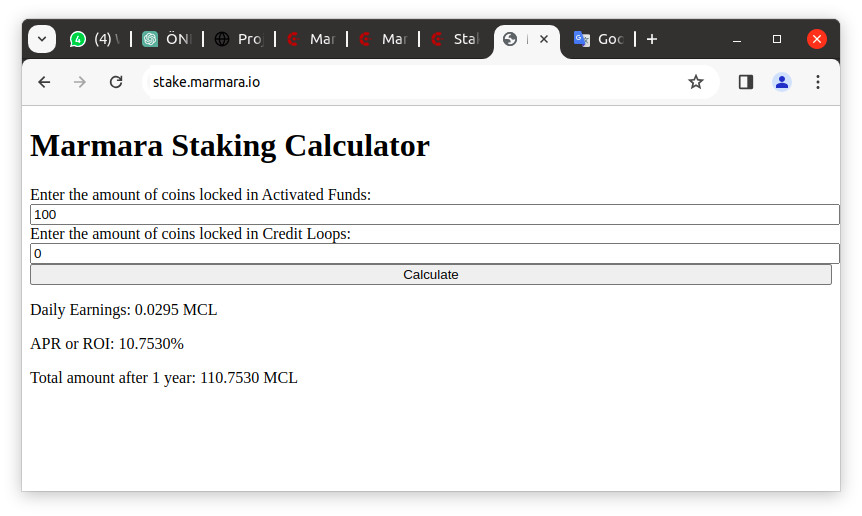

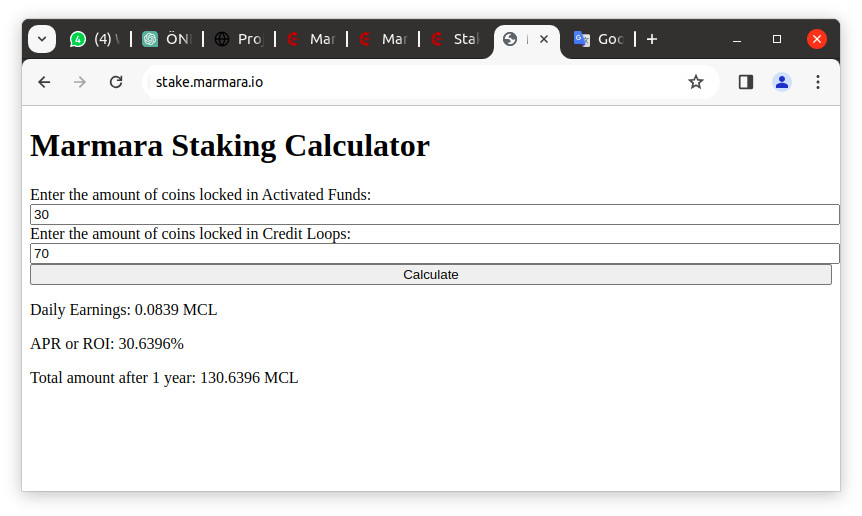

Remember that the calculations are dynamic on Marmara Chain since activated coins with 1x staking can be locked/unlocked by the stakers and maturity periods for coins locked in loops for 3x staking are decided by users. You can check your calculation results under different scenarios from simple http://stake.marmara.io page.

Lowest Staking Yield

Activated coins can be unlocked any time. But they give the lowest staking since they have only 1x staking power. In this scenario, all coins are locked into activated coins without any coin in credit loops. At the time of writing this blog post, the expected staking result as APR is as follows:-

The staking result is 10.75% annually with this scenario.

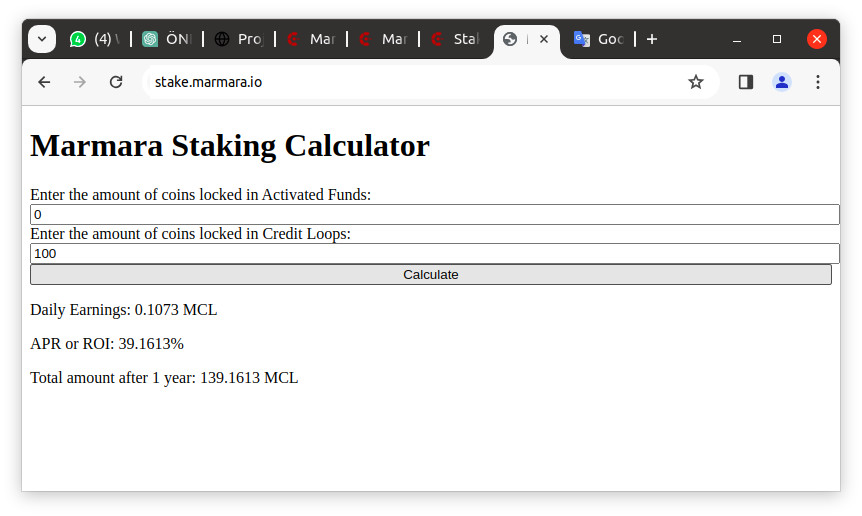

Highest Staking Yield

Coins locked in credit loops give the highest yields since they have 3x staking power. But they cannot be unlocked before maturity dates. However, they can be endorsed/transferred to a new holder in shopping just same as post-dated cheques that circulate in real economy. This provides a kind of liquidity without unlocking the coins. By endorsing coins locked in a credit loop, the 3x staking power is transferred to a new holder. If you are using the staking mechanism in an ecommerce system, you can simply transfer the ownership of 3x staking coins. At the time of writing this blog post, the expected staking result as APR is as follows for all coins :-

The staking result is 39.16% annually with this scenario. Since, in the time of calculation, the ratio of total activated coins is higher than in locked-in-loop coins, the estimated staking is more than 3x power for your arrangement.

Good News for Exchanges or e-Commerce Startups

You can arrange combinations of coins locked in activated or credit loops if you want to create a staking pool for your exchange or your ecommerce startup that uses MCL as main payment system. Since the coins locked in credit loops give the highest yielding due to 3x staking power, you need to make a simple optimization depending on your immediate liquidity request by the users. Just watch your statistics of your users to see how much is deposited and how much is withdrawn regularly. Since activated coins can be unlocked immediately, there will be no problem when certain ratio is locked in activated in your staking pool. Remember that banks only hold around 5% as reserve requirement to protect against to bank runs. See the reserve requirements in you country. Actually banks are very risky but they simply rely on that people will not run to the bank at the same time. With staking pool, you have the 100% collateralization but some needing maturity date if they are locked in credit loops. If you are ecommerce startup that can manage the endorsement/transfer of credit loops, then you are safe with any ratio. There is a startup project called Zincir Market in Technopark İstanbul. The startup provides zero commission system thanks to the power of staking mechanism in MCL.

The following pictures show a scenario with 30% of coins locked in activated while the remaining 70% is locked in credit loops. Obviously, 30% is much higher than any bank reserve requirement.

As can be seen from the picture, the combined annual staking yield with 30% vs 70% increases to 30.63% from 10.75% where the yield is when all coins are locked in 1x activated funds.

To start staking immediately read the blog post:

https://marmara.io/blog/marmara-chain-1/start-mining-or-staking-mcl-coin-easily-57