Marmara v.1.0

100% Self-assured Credit Loops System

In Protocol 1, all credits are fully collateralized

by issuers of credits. Therefore, there is no defaulting risk. For

providing this, issuers in credit loops have the right for 3x staking

until maturity dates of a credits.

Boosting Purchasing Power

Due to 100% assurance for redemption by issuers, there is no need for an escrow or aval at any point of shopping with credit loops in Protocol 1. Holders, i.e. providers of goods and services in a loop can benefit from 3x staking until they become endorsers by purchasing goods or services from new holders. By this way, they become endorsers and transfer their 3x staking right to new holders. There is no meaning for an endorser to transfer credit unless the transfer is for shopping since he/she transfer the 3x staking power.

MCL is the only staking system in the World where locked coins allow owners staking while they are circulating among people.

Estimation of Staking Rewards

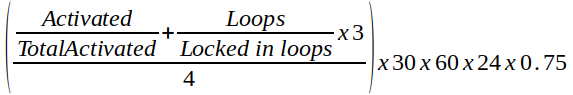

One may estimate the staking rewards by using the formula below. Please note that the formula gives only estimated results which may be varying with parameters such as the number and quantity of both activated and locked-in loop coins, their aging, the internet connection, hard disk speed, number of cores etc. However, the minimum requirement for hardware is low with 2 cores, 4 GB RAM, SSD Harddisk and a reasonable internet connection. You can even stake with a miniPC easily.

-

Activated: Activated amount (in your wallet)

-

Loops: Locked in loops (in your wallet)

-

*TotalActivated: Total activated amount

-

**Locked in Loops: Total Locked in loops amount

-

30: MCL per minute

-

60: Approx number of MCL blocks created per hour

-

24: 24 hours

-

0.75: Total staking rate

*,** : For Total Activated and Total Locked in loops amounts, visit here.

Marmara v.2.0

Trust Based Credit Loops

Escrow system and escrow services

Solution to Non-redemption in Trust Based Credit Loops

The requirement definitions have been completed for

trust-based blockchain solution (Version 2) but not yet been fully

implemented on the existing blockchain. The trust-based system works

similarly to the existing trust-based analog blockchain in paper-based

check checks, but with several preventive programs (3-layer

recommendation), self-assurance is provided against the problem of

non-payment (defaulting) or bouncing. In the trust-based blockchain

system, the issuer creates a credit similar to the banking system. The

difference here is that the credit created in blockchain is circulated

in a credit loop, in contrast to the bank credit where the credit

generally remains as the contract between the bank and the borrower.

Non-redemption problem in trust based credit loops is solved in a unique

way.

There are several layers of protection against

defaulting, i.e. non-redemption. First of all, the issuance and

settlement processes of trust based credit loops will be through Escrows acting as responsibility and trust centers. They can have additional guarantees to be used in case of no refunds.

Issuers and endorsers in the credit loop layer will most likely have active/locked coins to be used as a collaterals in case of defaulting. Avalists’ activated funds in community layer may also be used collaterals.

The blockchain fund layer will also be used as a last resort against nonredemption.

Escrow System

In trust-based mode, the issuance or settlement of credit loops are performed by trusted escrow service providers, which act as distributed notaries. Those who provide this intermediary services are called “Escrows”. All issuer nodes in credit loops must verify their data by an escrow service to join the credit loop system. The Escrow system is similar to Notarization system with more responsibilities.

Escrow Services

Mining/staking people can easily use the system with trustless features of Marmara Credit Loops. Data Management is only necessary for necessary people such as credit issuers and for trust based version.

Escrows and avalists in community layer provide an additional layer of trust in the blockchain. Currently, in the analog version of post-dated cheques, cheques are initiated by banks and banks do not issue checks to everyone. In case of promissory notes, avalists are more important. Escrows bear the main responsibility during issuance and settlement of peer-to-peer credits on Marmara system.

Data association for issuers must be through escrows. Escrows may be Web-based escrow services, Crypto Exchanges, Notaries, Post Offices, Law Offices, Credit Unions and even Banks. Not everyone can become an Escrow. Please contact us for details if you want to be an escrow.

To ensure that there is no identity theft in version 2, user (issuer) data should be managed by only through Escrows. This will be done by the Escrows with the their own Know Your Customer procedures, financial credit scoring system etc. Escrows will be responsible during issuance and settlement of trust based credit loops. Therefore, they will have earnings from blockchain fund in third layer planned for Version 2.